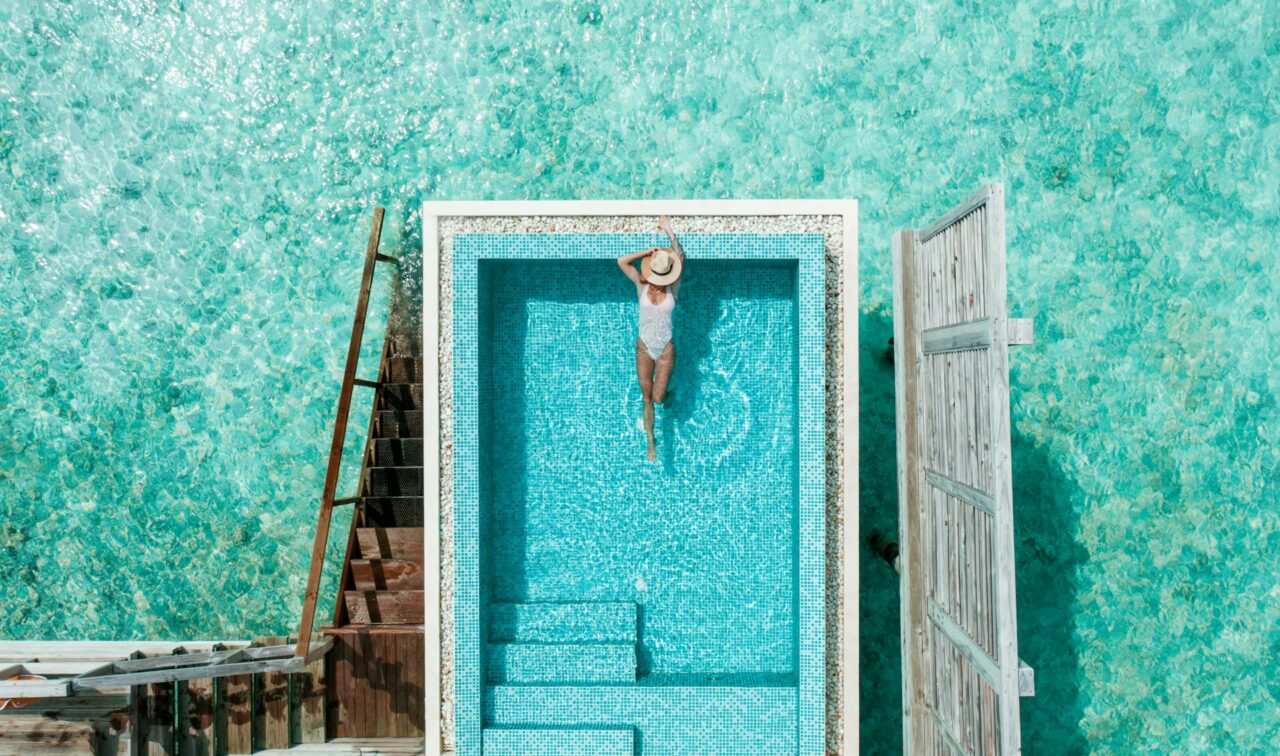

Traveling is exciting, but it also comes with its risks. Whether you’re venturing to a new city or exploring a remote destination, the unexpected can happen. From lost luggage to sudden cancellations, being prepared can save you a lot of trouble. One often-overlooked way to safeguard your trip is by using renter’s insurance. Though it’s typically associated with protecting your home and belongings, renter’s insurance can also offer you peace of mind while you travel.

Provide Liability Protection

If you’re involved in an incident while traveling – such as accidentally damaging someone else’s property or being responsible for an injury – liability coverage through your renter’s insurance could help protect you. This coverage can help pay for medical bills, repairs, or legal fees associated with the accident. Without renter’s insurance, you could be left footing the bill. If you’re involved in an accident while traveling, the costs for damages or injuries may be covered by tenant insurance, helping to protect you from unexpected financial responsibility. Liability protection ensures that you’re not financially responsible for every little mistake during your trip.

Protect Your Personal Belongings

When you’re traveling, you take your personal belongings with you – laptops, cameras, jewelry, and more. The last thing you want is for your valuables to be lost, stolen, or damaged while you’re away. Standard renter’s insurance policies often include personal property protection, which can extend beyond your home. This means that if your belongings are damaged or stolen during your travels, your insurance policy might cover the cost of replacing them. With the right coverage, you’ll be able to replace your items without taking a hit to your wallet. It’s a small investment that can make a big difference if something goes wrong while you’re on the road.

Cover Your Temporary Accommodations

Suppose you arrive at your rented space and find that it’s been damaged or isn’t as described. Your renter’s insurance might cover the cost of finding another place to stay, easing the stress of having to rearrange your plans. if a disaster like a fire or flood happens in your temporary accommodations, leaving you with nowhere to stay, renter’s insurance can cover the cost of finding alternate lodging. Knowing that your insurer has your back can make all the difference in ensuring a smooth trip, no matter what surprises arise.

Provide Emergency Assistance

While it’s not common knowledge, some renter’s insurance policies provide emergency assistance for things like emergency evacuation, lost passport coverage, or even medical transportation. If something unexpected happens while you’re traveling – such as a natural disaster forcing you to leave an area or a sudden medical issue – your renter’s insurance could provide resources and support. This emergency assistance may not be available in every policy, so it’s important to check your insurance provider’s fine print. However, if you do have access to this benefit, it can add an extra layer of safety and peace of mind to your travels.

Renter’s insurance offers more than just protection for your home – it can safeguard your belongings, provide temporary accommodations, offer liability protection, and even assist in emergencies while you’re on the go. It’s a simple yet effective way to ensure that you’re covered if something goes wrong during your trip. By taking the time to review your renter’s insurance policy and considering the added benefits, you can travel with confidence, knowing that you’re protected in case of the unexpected.